Grace Ballet & Acrobatics Studio, owned by Anna Johnson, has successfully operated for two decades, and with the assistance of the SBA 504 Loan Program, she was able to lock in a lower fixed interest rate to increase profit margins and create stability. Grace Ballet Studio will continue to help kids in Des Moines, Iowa, learn, dance, and build confidence for years to come.

Anna Johnson’s Grace Ballet & Acrobatics Studio’s core tenets are serving the community through Spirit-led simplicity via ballet and acrobatics for children aged 2.5 – 18 years.

Economic Development Objectives Fulfilled

- Name: Grace Ballet & Acrobatics Studio

- Location: Des Moines, IA

- Jobs Created/Retained: 15

- Public Policy Goals Fulfilled: Enterprise/Opportunity/Revitalization Zone; Woman-Owned Business

- Lending Partner: Zions First National Bank

New Opportunities to Grow Your Business: Think 504 When…

- You are looking to buy, build or renovate a commercial facility

- You need to finance the purchase of heavy machinery or equipment

- You are looking to add multiple retail locations

- Your business is buying real estate as part of a business acquisition

- An owner wants to sell his/her share of real estate to the other owners

- A balloon payment is coming due on your commercial mortgage and you want to refinance the debt into a long-term, fixed-rate loan

- A 25-year loan could help manage your operating capital

12 benefits that prove SBA 504 Loans were specifically designed to help businesses expand and prosper…

SBA 504 Loans from Growth Corp feature:

- Low down payments (10% in most cases)

- Low, fixed interest rate on the 504 portion

- Long loan terms (10-, 20-, or 25-year terms)

- The ability to include furniture, fixtures and fees

- An option for refinancing commercial debt

- Payment stability

- Preservation of working capital

- Protection from balloon payments

- The ability to include leasehold improvements

- Up to $5 million for SBA portion of the loan, and no limit on the overall project size

- The option of using the 504 Loan Program multiple times to continue expansion

- The ability to keep your current bank/lender

How Does the 504 Loan Program Work?

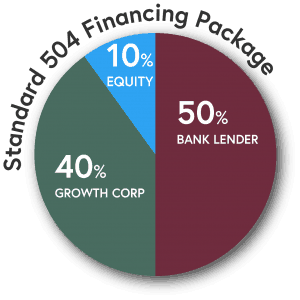

The 504 program offers financing that covers 90% of a project’s total cost, as opposed to the 70%-80% offered with most conventional loan programs. The typical breakdown of the funds in a 504 loan is:

50 percent from a bank or other private lender,

- 40 percent from the SBA, and

- 10 percent from the borrower

Business owners can reduce their initial capital outlays by as much as $1 million in some circumstances by leveraging the 504 Program’s 90 percent loan-to-cost financing. To qualify for the SBA 504 Loan Program, the business must:

- have fewer than 500 employees

- be located in the United States

- be a for-profit business

- have a tangible net worth of not more than $20 million and average net income after taxes (two years prior to application) of not more than $6.5 million

- be owner-occupied

- if a manufacturing company, meet the definition of a small to mid-sized manufacturer as classified in the North American Industry Classification System, sectors 31-33.

50 percent from a bank or other private lender,

50 percent from a bank or other private lender,