Looking for the best financing to buy or sell commercial real estate? Look no further than the SBA 504 Loan Program.

Many small business owners think financing a commercial real estate purchase isn’t an option because they’ve heard the down payments can be very high. However, there are options for business owners who can’t afford to contribute 20, 30 or even 35 percent of the project in the form of a down payment. Let’s take a look at five ways the Small Business Administration’s (SBA) 504 loan can help both buyers and sellers reach their goals.

Five Reasons SBA 504 is the Best Financing to Buy or Sell Commercial Real Estate

1. Low Down Payment Requirements

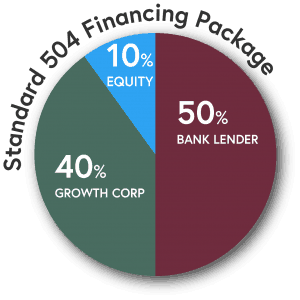

For businesses looking to protect their cash flow, or facing tighter cash flow because of higher interest rates, the SBA 504 offers an advantage. Down payments as low as ten percent. This amounts to huge cash savings as most conventional loans require 20%, or even up to 35%, down.

2. Low, Long-term, Fixed Interest Rates

Conventional loan rates are typically only fixed for a certain period of time, usually 3-10 years. After that, the rate is reset and could become variable. In a rising rate environment, that means you could find yourself with a much higher rate in the future. Conversely, a long-term fixed-rate mortgage, such as the SBA 504, locks in today’s low interest rates and eliminates concern over future interest rate hikes. You’ll see predictable and lower monthly payments.

3. No Balloon Payments or Call Provisions

A balloon loan mortgage, common in commercial real estate, is usually a short mortgage that requires a large one-time payment at the end of the term. This can mean your payments are lower in the years before the balloon payment comes due, but you will either owe a lump sum at the end or be required to refinance the balance. This can lead to another round of building appraisals and credit approvals to endure. However, unlike conventional commercial real estate loans, a 504 Loan has no balloon payments.

Call provisions are similar to balloon payments in that, with a conventional loan, you may be required to maintain a specific debt-service coverage ratio as a way for lenders to lower their risk. If you fail to meet that provision, the bank can “call in” your loan. This means you would either have to pay off the balance, or refinance it. The SBA 504 Loan Program has no covenants or call provisions either. What you get is a long-term, fixed rate loan offering secure, predictable monthly payments for the life of the loan.

4. Financing Includes Closing Costs, Soft Costs and Other Fees

All loans come with closing costs, which include appraisals, loan origination fees, etc. These expenses can add up quickly. Conventional financing typically requires all closing costs to be paid upfront, but SBA 504 loans allow you to roll them into the loan, thus preserving your cash. Not to mention, if you are expanding your business, the cost of equipment, furniture and fixtures, parking lots, architectural fees, etc. can also be rolled into the loan, saving you even more.

5. SBA 504 Loans Are Attractive To Conventional Lenders

SBA 504 loans offer banks a good deal, as well. Your 504 loan is a low risk for the conventional bank because they hold the first mortgage. They have a lien on the whole property, even though they are only financing a portion of it. It is an easy way for the bank to attract new business and to enlarge their impact in the community. This means that you are more likely to get financing from a conventional bank when you are backed by the SBA with a 504 loan. The bank may even give you better conditions than they would offer otherwise.

Benefits to Commercial Real Estate Buyers…

- Low down payments – usually just 10%

- Low, fixed interest rates (check out the historical interest rates)

- Long loan-terms (10-, 20-, or 25-year terms)

- The ability to include FF&E

- An option for refinancing commercial mortgage debt

- Payment stability – no rent or interest rate increases

- Protection from balloon payments

- Preservation of working capital

- No limit on total project size

- Up to $5 million for the SBA 504 portion

- The freedom to use the 504 multiple times (so long as the aggregate SBA portion remains below the $5 million limit)

- The ability to keep current bank/lender relationships

Benefits to Commercial Real Estate Agents…

The SBA 504 Loan Program’s low down payments and affordable terms can make commercial real estate ownership a reality for business owners, allowing commercial real estate agents to get more clients into their own commercial buildings. Here are seven ways SBA 504 Loans are beneficial to commercial real estate agents:

- Make a deal happen that might not have worked with conventional financing

- Offers low down payments so clients can preserve their cash

- Attracts more buyers with access to 25-yr fixed terms

- The financing can include parking lots, renovations, soft costs, fees, landscaping, FF&E, street improvements, etc.

- Can assist clients looking to finance multiple locations

- Clients find the benefits of a 504 Loan make purchasing a more attractive option than leasing

- Invest in your future – Realtors can use the 504 to buy or build their own office space

What Can SBA 504 Loans Be Used For?

- Purchasing land and its improvements (including grading, street improvements, utilities, parking lots, and landscaping)

- Construction of new facilities

- Modernizing, renovating, or converting existing facilities

- Purchasing machinery/equipment

- Proceeds can also be used to refinance existing qualified debt

Is Your Commercial Real Estate Project a Fit for the 504 ?

- Does it involve CRE? Is your client looking to purchase land and/or buy or build a commercial property?

- Will the property be owner-occupied? Will the client occupy at least 51% of the project property (60% of new construction)

- Is it a for-profit business? Is the client a for-profit business located in the United States?

- Is it size eligible? Does the business have a tangible net worth less than $20 million and 2-yr average after tax profits of less than $6.5 million?

Here’s an example of a recently sold property that would be a perfect fit for SBA 504 financing: https://buildout.com/connect/sharing/1298340-lease?file=3247177

SBA 504 Case Study

The Solution: Utilizing the 504 Loan Program, 90% of the project costs were financed thereby conserving the company’s cash and preserving the necessary working capital to support continued growth.

The Result: The combined monthly payment on the acquisition of their new building is actually less than their leased payment was and the company was able to stay local. In addition, with more space, they were able to expand production and add 5 new, full-time jobs.

If you are interested in a loan, or have questions about it, don’t hesitate to contact Growth Corp. Growth Corp’s 504 loan experts will be happy to answer all of your questions, as well as to help guide you through the 504 loan process. Growth Corp has been a high-volume 504 loan provider for over 35 years and is an Accredited Lender with SBA.